Strategic Collaborations for Resilience: Bagley Risk Management

Strategic Collaborations for Resilience: Bagley Risk Management

Blog Article

Just How Livestock Danger Security (LRP) Insurance Policy Can Secure Your Livestock Investment

Livestock Threat Protection (LRP) insurance stands as a reliable guard versus the unpredictable nature of the market, offering a critical approach to securing your assets. By diving into the complexities of LRP insurance policy and its multifaceted advantages, animals manufacturers can strengthen their financial investments with a layer of protection that goes beyond market variations.

Understanding Livestock Threat Defense (LRP) Insurance

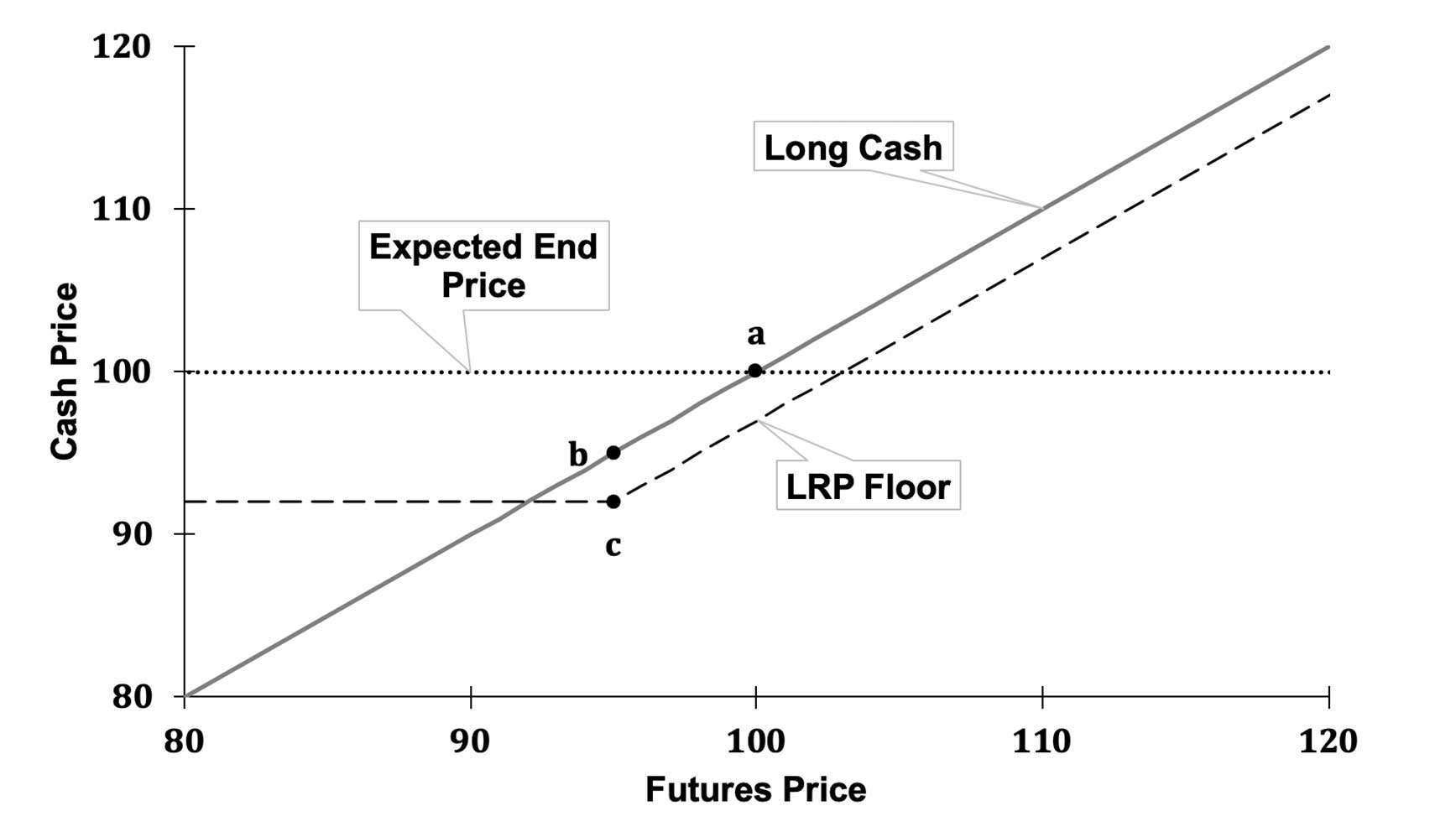

Understanding Livestock Risk Protection (LRP) Insurance policy is important for animals producers looking to reduce economic threats linked with price changes. LRP is a government subsidized insurance coverage item created to safeguard manufacturers against a decrease in market value. By supplying coverage for market value declines, LRP assists manufacturers secure in a flooring cost for their animals, making certain a minimum level of revenue no matter market variations.

One key facet of LRP is its versatility, enabling producers to customize protection levels and plan lengths to suit their particular requirements. Manufacturers can select the variety of head, weight range, insurance coverage cost, and coverage duration that straighten with their manufacturing goals and run the risk of tolerance. Comprehending these personalized alternatives is essential for manufacturers to effectively handle their price threat direct exposure.

In Addition, LRP is offered for various livestock kinds, consisting of livestock, swine, and lamb, making it a flexible danger administration device for animals producers throughout various fields. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make enlightened choices to guard their financial investments and make sure economic stability when faced with market uncertainties

Benefits of LRP Insurance Policy for Animals Producers

Livestock manufacturers leveraging Animals Risk Protection (LRP) Insurance policy obtain a strategic advantage in shielding their financial investments from price volatility and protecting a secure monetary footing amidst market uncertainties. By setting a flooring on the price of their livestock, producers can alleviate the risk of substantial monetary losses in the occasion of market declines.

Furthermore, LRP Insurance coverage supplies manufacturers with tranquility of mind. Overall, the benefits of LRP Insurance coverage for livestock manufacturers are significant, offering an important device for managing risk and guaranteeing monetary security in an unforeseeable market atmosphere.

Exactly How LRP Insurance Mitigates Market Threats

Alleviating market dangers, Livestock Danger Defense (LRP) Insurance supplies animals producers with a trustworthy guard against rate volatility and economic uncertainties. By providing defense versus unexpected rate drops, LRP Insurance policy helps producers secure their investments and preserve economic security despite market changes. This sort of insurance coverage allows animals manufacturers to secure a price for their animals at the beginning of the plan duration, ensuring a minimum rate level no matter market modifications.

Actions to Secure Your Animals Financial Investment With LRP

In the world of farming risk administration, applying Animals Danger Protection (LRP) Insurance coverage involves a strategic procedure to guard investments versus market fluctuations and uncertainties. To secure your animals financial investment successfully with LRP, the very first step is to assess the certain risks your operation encounters, such as cost volatility or unforeseen weather occasions. Comprehending these risks allows you to establish the insurance coverage degree required to shield your investment adequately. Next, it is vital to study and select a respectable insurance coverage company that uses LRP policies tailored to your animals and company requirements. Very carefully evaluate the plan terms, conditions, and protection limitations to ensure they line up with your risk monitoring goals once you have selected a supplier. Additionally, regularly monitoring market trends and changing your insurance coverage as required can help enhance your protection against prospective losses. By complying with these steps faithfully, you can improve the security of your animals investment and browse market uncertainties with self-confidence.

Long-Term Financial Security With LRP Insurance

Guaranteeing enduring financial security through the use of Animals Danger Defense (LRP) Insurance is a sensible long-lasting technique for farming manufacturers. By including LRP Insurance coverage right linked here into their danger administration plans, farmers can protect their animals financial investments versus unexpected market changes and negative occasions that might jeopardize their economic wellness in time.

One trick advantage of LRP Insurance coverage for lasting economic safety and security is the satisfaction it provides. With a dependable insurance coverage in position, farmers can minimize the economic risks related to volatile market conditions check this site out and unforeseen losses as a result of elements such as condition episodes or natural catastrophes - Bagley Risk Management. This stability allows producers to focus on the daily operations of their animals service without continuous worry about prospective monetary problems

In Addition, LRP Insurance coverage supplies a structured technique to managing risk over the long-term. By establishing particular protection levels and choosing suitable endorsement periods, farmers can customize their insurance plans to line up with their financial objectives and risk resistance, making sure a safe and secure and lasting future for their animals procedures. To conclude, spending in LRP Insurance coverage is an aggressive method for farming producers to accomplish enduring economic safety and security and shield their livelihoods.

Verdict

In verdict, Livestock Threat Defense (LRP) Insurance coverage is a useful device for animals producers to mitigate market threats and secure their investments. It is a wise option for protecting livestock investments.

Report this page